Securing the ideal mezzanine financing provider requires extensive research, meticulous evaluation, and a strategic approach to the entire process. It is critical to honestly scope out your financial requirements, assess the provider's expertise, and consider factors such as reputation, flexibility, and support. Throughout this process, it is important to conduct thorough due diligence and seek guidance from professionals to ensure informed decision-making.

Introduction

Mezzanine financing is a popular option for businesses seeking capital to fuel growth, fund acquisitions, or optimize their financial structure. It combines elements of debt and equity financing, offering companies flexibility and a higher-risk capital solution. However, finding the right mezzanine financing provider can be a daunting task. In this comprehensive guide, we will explore the essential steps and considerations to help you find the ideal mezzanine financing provider for your business needs.

For more information, check out: The Comprehensive Guide to Mezzanine Financing

Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. Gain a comprehensive understanding of how it works, what are its advantages, and the process of obtaining mezzanine financing for your business! Read this guide and make a well-informed decision!

Research Phase

For more information…

Understanding Mezzanine Financing Sources - Mezzanine financing sources provide businesses with diverse ways to acquire capital, extending beyond the conventional methods of debt or equity financing. Various entities exist, such as private equity firms, venture capital funds, mezzanine debt funds, commercial banks, business development companies, and family offices.

Understanding Mezzanine Financing Sources - Mezzanine financing sources provide businesses with diverse ways to acquire capital, extending beyond the conventional methods of debt or equity financing. Various entities exist, such as private equity firms, venture capital funds, mezzanine debt funds, commercial banks, business development companies, and family offices.Understand Mezzanine Financing

Before diving into the search for mezzanine financing providers, it’s crucial to understand what mezzanine financing entails. Mezzanine financing bridges the gap between senior debt and equity financing, often acting as a subordinated loan or preferred equity investment. This form of financing offers flexible terms, potential equity upside, and higher interest rates compared to traditional debt.

Define Your Financing Needs

Start by clearly defining your financing needs and objectives. Determine the specific amount of capital required, the purpose of the funds, and the timeline for repayment. Consider your company’s risk profile and growth potential to align your needs with the right mezzanine financing provider.

Research Mezzanine Financing Providers

Conduct thorough research to identify potential mezzanine financing providers that cater to businesses in your industry and geographical location. Leverage online resources, industry publications, and professional networks to compile a list of reputable providers. Some well-known mezzanine financing providers include private equity firms, specialized debt funds, and venture capital firms.

Evaluate and Assess

For more information…

List of Mezzanine Financing Companies in the USA – June 2023 - When seeking mezzanine funding providers, it is essential to have access to a reliable and up-to-date list. Generic lists found on various websites often lack crucial details, making it difficult to effectively target providers. However, by leveraging the expertise and resources of mezzanine funding experts like GoodLoansGuide, you can gain a competitive edge and increase your chances of securing the right funding for your business.

List of Mezzanine Financing Companies in the USA – June 2023 - When seeking mezzanine funding providers, it is essential to have access to a reliable and up-to-date list. Generic lists found on various websites often lack crucial details, making it difficult to effectively target providers. However, by leveraging the expertise and resources of mezzanine funding experts like GoodLoansGuide, you can gain a competitive edge and increase your chances of securing the right funding for your business.Evaluate Track Record and Expertise

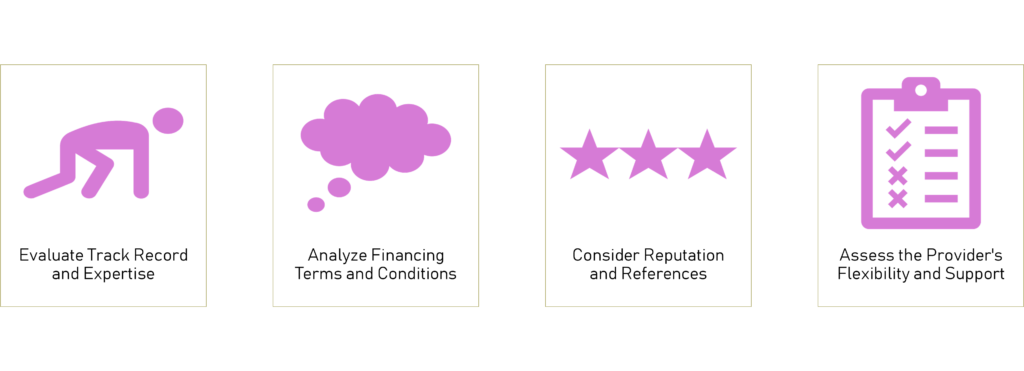

Assess the track record and expertise of each potential mezzanine financing provider. Look for providers with a history of successful mezzanine financing transactions, particularly in your industry or sector. Consider their experience, reputation, and understanding of the unique challenges and opportunities your business faces.

Analyze Financing Terms and Conditions

Review and compare the financing terms and conditions offered by different providers. Look beyond the interest rates and repayment terms and consider other factors such as equity participation, governance rights, and exit strategies. Ensure the financing structure aligns with your company’s long-term goals and doesn’t impose undue constraints.

Consider Reputation and References

Reputation matters when it comes to selecting a mezzanine financing provider. Seek feedback from industry peers, advisors, and trusted sources to evaluate each provider’s reputation. Additionally, ask potential providers for references from companies they have previously financed. Reach out to these references to gain insights into their experiences and the provider’s reliability.

Assess the Provider’s Flexibility and Support

Mezzanine financing providers should offer more than just capital. Assess their ability to be flexible and supportive partners throughout the financing term. Consider whether they are willing to accommodate your changing needs, provide strategic guidance, and leverage their network to help your business thrive.

Due Diligence and Finalize

For more information…

Mezzanine Financing: Negotiating and Structuring the Deal - Mezzanine financing presents a flexible funding alternative for most companies looking to grow rapidly. However, to navigate the structuring of a mezzanine financing arrangement effectively, it is essential to understand the basic terms, align interests with the lender, and mitigate potential risks. Through systematic evaluation of the advantages and risks, borrowers can use this financial option to obtain the capital required for expansion while safeguarding ownership and control.

Mezzanine Financing: Negotiating and Structuring the Deal - Mezzanine financing presents a flexible funding alternative for most companies looking to grow rapidly. However, to navigate the structuring of a mezzanine financing arrangement effectively, it is essential to understand the basic terms, align interests with the lender, and mitigate potential risks. Through systematic evaluation of the advantages and risks, borrowers can use this financial option to obtain the capital required for expansion while safeguarding ownership and control.Conduct Due Diligence

Perform comprehensive due diligence on the shortlisted mezzanine financing providers. Evaluate their financial stability, regulatory compliance, and legal standing. Assess their internal processes, risk management framework, and decision-making criteria. This step is crucial to ensure the provider is trustworthy, reliable, and aligned with your business objectives.

Seek Professional Advice

Consider engaging professional advisors such as investment bankers, lawyers, or financial consultants experienced in mezzanine financing. They can provide invaluable guidance throughout the process, assisting with the evaluation, negotiation, and structuring of the financing deal.

Negotiate and Finalize the Deal

Once you have selected a mezzanine financing provider, engage in detailed negotiations to finalize the deal. Work closely with your advisors to ensure favorable terms, protect your company’s interests, and ensure alignment between both parties. Seek clarity on reporting requirements, covenants, and potential future funding options.

Conclusion

Finding the right mezzanine financing provider requires diligent research, thorough evaluation, and strategic decision-making. By understanding your financing needs, evaluating provider expertise, and considering reputation, flexibility, and support, you can increase your chances of securing a reliable and suitable mezzanine financing solution. Remember to conduct due diligence and seek professional advice throughout the process to make informed decisions. With the right provider, mezzanine financing can become a catalyst for your business’s growth and success.