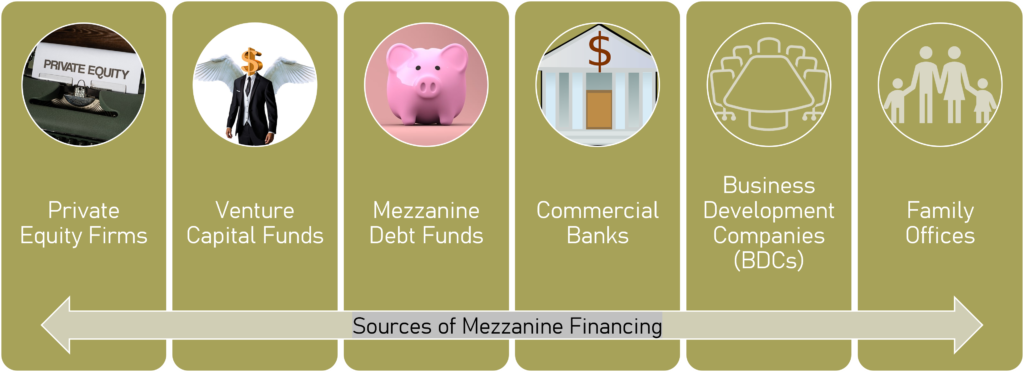

Mezzanine financing sources provide businesses with diverse ways to acquire capital, extending beyond the conventional methods of debt or equity financing. Various entities exist, such as private equity firms, venture capital funds, mezzanine debt funds, commercial banks, business development companies, and family offices.

Introduction

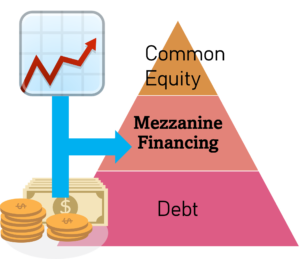

Mezzanine financing is a form of funding that bridges the gap between traditional bank loans and equity investments. It provides businesses with the necessary capital to support growth, acquisitions, and other strategic initiatives. In this article, we will explore the world of mezzanine financing sources and shed light on the various options available to entrepreneurs and companies looking to expand their operations.

For more information, check out: The Comprehensive Guide to Mezzanine Financing

Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. Gain a comprehensive understanding of how it works, what are its advantages, and the process of obtaining mezzanine financing for your business! Read this guide and make a well-informed decision!

Sources of Mezzanine Financing

For more information…

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.Private Equity Firms

Private equity firms are major players in the mezzanine financing landscape. They specialize in investing capital in businesses with significant growth potential. These firms provide mezzanine financing in the form of subordinated debt or preferred equity. They are attracted to companies with solid financials, a proven track record, and a clear growth strategy.

Venture Capital Funds

Venture capital funds, similar to private equity firms, offer mezzanine financing to high-growth companies. These funds invest in early-stage or expansion-stage businesses that have the potential for substantial returns. Venture capital firms often structure their mezzanine financing deals to align with their investment objectives, which may include convertible debt or equity with favorable terms.

Mezzanine Debt Funds

Mezzanine debt funds are specialized investment vehicles that focus exclusively on providing mezzanine financing. These funds raise capital from institutional investors and deploy it to companies in need of additional funding. Mezzanine debt funds offer flexible financing options, customized terms, and higher risk tolerance compared to traditional lenders.

Commercial Banks

While commercial banks primarily offer senior debt, they may also participate in mezzanine financing arrangements. Banks may provide mezzanine financing as a complement to their senior debt offerings or through affiliated investment arms. Although less common than other sources, commercial banks can be a viable option for companies with established relationships and solid creditworthiness.

Business Development Companies (BDCs)

Business Development Companies are publicly traded investment firms that provide mezzanine financing to middle-market companies. BDCs are regulated investment vehicles that offer investors the opportunity to invest in a diversified portfolio of mezzanine debt and equity securities. They provide flexible financing solutions to companies seeking capital for growth, acquisitions, and recapitalizations.

Family Offices

Family offices, representing wealthy individuals or families, are increasingly participating in mezzanine financing transactions. These private investment offices offer flexible capital solutions tailored to the specific needs of companies. Family offices often have a long-term investment horizon and can provide patient capital that supports a company’s growth objectives.

For more information…

Finding Mezzanine Financing Providers: A Step by Step Approach - Securing the ideal mezzanine financing provider requires extensive research, meticulous evaluation, and a strategic approach to the entire process. It is critical to honestly scope out your financial requirements, assess the provider's expertise, and consider factors such as reputation, flexibility, and support. Throughout this process, it is important to conduct thorough due diligence and seek guidance from professionals to ensure informed decision-making.

Finding Mezzanine Financing Providers: A Step by Step Approach - Securing the ideal mezzanine financing provider requires extensive research, meticulous evaluation, and a strategic approach to the entire process. It is critical to honestly scope out your financial requirements, assess the provider's expertise, and consider factors such as reputation, flexibility, and support. Throughout this process, it is important to conduct thorough due diligence and seek guidance from professionals to ensure informed decision-making.Conclusion

Mezzanine financing sources offer businesses a range of options for accessing capital beyond traditional debt or equity financing. Private equity firms, venture capital funds, mezzanine debt funds, commercial banks, business development companies, and family offices all play significant roles in this arena. Understanding these sources and their unique characteristics can empower entrepreneurs and companies to make informed decisions when seeking mezzanine financing for their growth and expansion plans.