Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. By gaining a comprehensive understanding of its characteristics, advantages, and the process of obtaining it, businesses can make well-informed choices and unlock the immense potential of mezzanine financing. Learn about this strategic financing alternative and leverage its capabilities to propel your business towards growth.

Introduction

When it comes to running a business, having access to the right financing options is crucial for growth and success. One such option that can unlock valuable opportunities is mezzanine financing. In this comprehensive guide, we will explore what mezzanine financing is and how it can benefit businesses.

Mezzanine financing is a unique form of funding that combines elements of debt and equity. It provides businesses with the means to raise capital for various purposes, such as expanding operations, acquiring assets, or managing working capital needs.

Unlike traditional bank loans, mezzanine financing offers businesses more flexibility in terms of repayment and collateral requirements. It also allows for a potentially higher return on equity for investors.

Throughout this guide, we will delve into the key aspects of mezzanine financing, including its definition, advantages, disadvantages, and the considerations involved. We will discuss the parties involved in mezzanine financing, the different structures it can take, and how businesses can evaluate their eligibility for this type of financing.

Moreover, we will guide you through the process of obtaining mezzanine financing, from finding suitable lenders to negotiating terms and closing the deal. We will also provide real-world case studies and success stories to illustrate how mezzanine financing has been successfully used by businesses across various industries.

By the end of this guide, you will have a comprehensive understanding of mezzanine financing and be equipped with the knowledge to assess whether it is a viable option for your business’s growth and financial needs. So, let’s begin our exploration of mezzanine financing and discover the opportunities it can unlock for your business.

Section 1: Understanding Mezzanine Financing

1.1 What is Mezzanine Financing?

Mezzanine financing is a unique type of funding that combines features of both debt and equity financing. It provides businesses with an opportunity to raise capital for various purposes, like expanding operations, acquiring assets, or managing working capital needs.

In simpler terms, mezzanine financing sits in between traditional bank loans and ownership shares. It offers businesses a flexible financing option that can be tailored to their specific needs and goals.

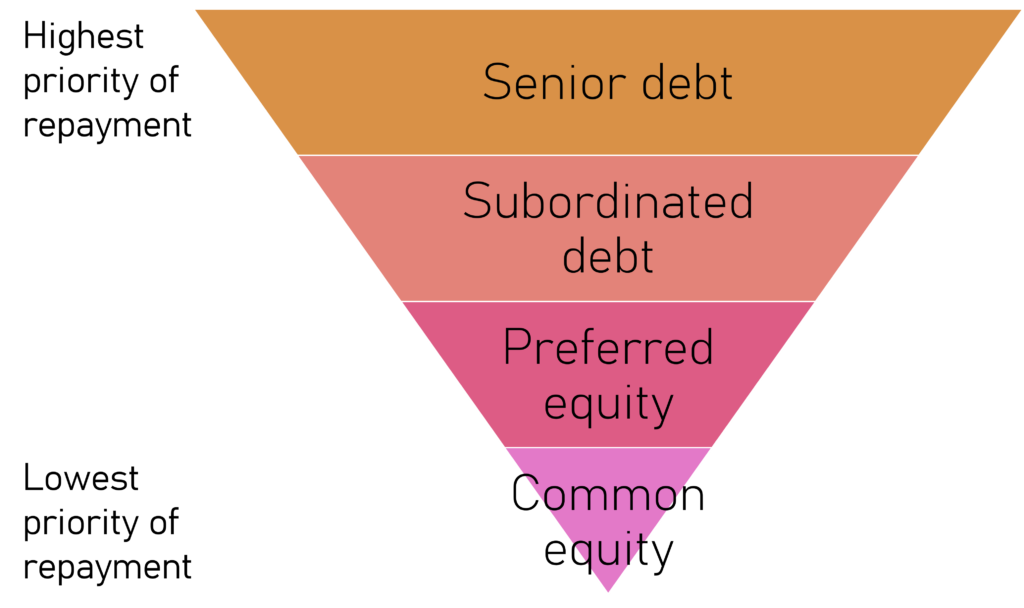

Unlike traditional debt, mezzanine financing involves a subordinated debt structure, meaning it ranks below senior debt in terms of priority during repayment. However, it also includes equity features, such as the potential for equity participation or conversion into equity in the future.

This hybrid nature of mezzanine financing allows businesses to access a larger pool of funds and gain financial flexibility while minimizing the dilution of ownership compared to purely equity-based financing.

Overall, mezzanine financing offers businesses an alternative avenue to raise capital and pursue growth opportunities, striking a balance between debt and equity financing.

1.2 Parties Involved in Mezzanine Financing

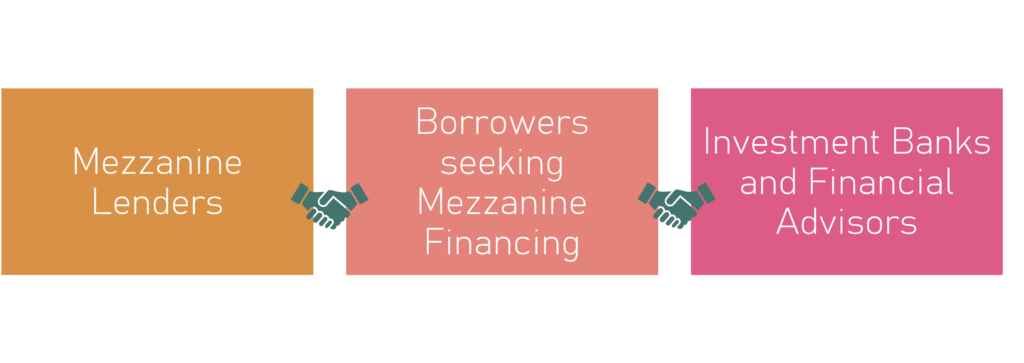

Mezzanine financing involves several parties working together to facilitate the funding process. Let’s take a closer look at the key players:

- Mezzanine Lenders: These are financial institutions or specialized lenders that provide mezzanine financing to businesses. They assess the creditworthiness and growth potential of the borrower, structure the financing deal, and provide the necessary funds. Mezzanine lenders often have expertise in evaluating complex financial transactions.

- Borrowers seeking Mezzanine Financing: These are businesses that require additional capital for growth or strategic initiatives. They approach mezzanine lenders to secure funding and present a compelling business case that highlights their growth potential and ability to generate returns.

- Investment Banks and Financial Advisors: Investment banks and financial advisory firms play a crucial role in mezzanine financing. They help borrowers identify suitable mezzanine lenders, assist in preparing financial documentation, negotiate deal terms, and provide strategic advice throughout the process. These professionals have a deep understanding of the mezzanine financing landscape and can guide borrowers through the complexities involved.

The collaboration between these parties is essential to ensure a successful mezzanine financing transaction. Mezzanine lenders provide the necessary funds, borrowers present a strong case for funding, and investment banks or financial advisors facilitate the process and provide expertise to navigate the intricacies of mezzanine financing.

1.3 Mezzanine Financing Structures

For more information…

Demystifying Mezzanine Financing Structures - Mezzanine financing offers businesses a distinct funding solution that blends debt and equity components. This financial structure acts as a bridge, filling the space between senior debt and equity, and empowers companies to secure supplementary capital for endeavors like expansion, acquisitions, or strategic initiatives. Nevertheless, it is essential to carefully assess the cost of capital, repayment capacity, and accompanying risks prior to selecting mezzanine financing.

Demystifying Mezzanine Financing Structures - Mezzanine financing offers businesses a distinct funding solution that blends debt and equity components. This financial structure acts as a bridge, filling the space between senior debt and equity, and empowers companies to secure supplementary capital for endeavors like expansion, acquisitions, or strategic initiatives. Nevertheless, it is essential to carefully assess the cost of capital, repayment capacity, and accompanying risks prior to selecting mezzanine financing.Mezzanine financing offers various structures that cater to the specific needs of businesses seeking funding. Let’s explore the common structures used in mezzanine financing:

Subordinated Debt

This is the most prevalent structure in mezzanine financing. It involves providing a loan that ranks below senior debt but above equity in terms of repayment priority. Subordinated debt typically carries a higher interest rate compared to senior debt due to its increased risk profile.

Convertible Notes

In this structure, the mezzanine lender provides a loan that can be converted into equity at a later stage, usually upon certain predefined conditions. Convertible notes allow businesses to benefit from debt-like financing initially and potentially convert it into equity if the business achieves certain milestones or experiences a significant event, such as an acquisition or IPO.

Equity Kickers

Equity kickers are additional benefits attached to mezzanine financing, allowing the lender to gain potential equity upside. For example, the lender may receive equity warrants or options, which give them the right to purchase shares of the borrower’s company at a predetermined price in the future. This provides the lender with an opportunity to participate in the potential growth of the borrower’s business.

These different structures offer flexibility in meeting the needs and risk appetite of both the borrower and the lender. Subordinated debt provides a straightforward loan repayment structure, convertible notes offer the potential for equity participation, and equity kickers provide additional upside potential for the lender.

It is essential for businesses to understand the nuances of each structure and choose the one that aligns with their financial goals and risk tolerance. The structure selected will depend on factors such as the borrower’s growth prospects, the lender’s preferences, and the specific requirements of the financing transaction.

Section 2: Advantages and Disadvantages of Mezzanine Financing

For more information…

Exploring the Pros and Cons of Mezzanine Financing - Mezzanine financing offers a range of benefits and possible drawbacks for businesses and investors alike. It provides businesses with greater flexibility, borrowing capacity, customizable terms, and the potential for higher returns. The downsides could include higher costs, amplified risk, intricate structures, and the possibility of equity dilution. It is crucial to carefully evaluate these factors as they can significantly impact the overall viability of the financing option.

Exploring the Pros and Cons of Mezzanine Financing - Mezzanine financing offers a range of benefits and possible drawbacks for businesses and investors alike. It provides businesses with greater flexibility, borrowing capacity, customizable terms, and the potential for higher returns. The downsides could include higher costs, amplified risk, intricate structures, and the possibility of equity dilution. It is crucial to carefully evaluate these factors as they can significantly impact the overall viability of the financing option.2.1 Advantages of Mezzanine Financing

Mezzanine financing offers several advantages that make it an attractive option for businesses seeking funding. Let’s explore some of these advantages:

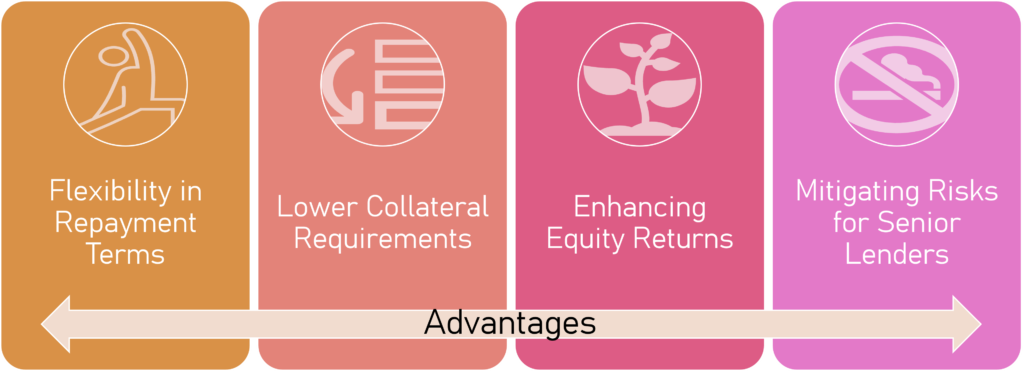

Flexibility in Repayment Terms

Mezzanine financing provides greater flexibility in repayment compared to traditional bank loans. It allows businesses to structure the repayment terms based on their cash flow and growth projections. This flexibility can help alleviate financial strain during periods of lower cash flow or when the business is in its growth phase.

Lower Collateral Requirements

Mezzanine financing typically requires less collateral compared to traditional debt financing. This is because mezzanine lenders have a subordinated position in the capital structure, meaning they accept a lower priority in repayment. As a result, businesses can access funding without having to pledge significant assets as collateral, freeing up valuable resources for other purposes.

Enhancing Equity Returns

Mezzanine financing can enable businesses to enhance their equity returns. By utilizing mezzanine financing, businesses can leverage the available equity capital and deploy it for growth initiatives, such as expanding operations or pursuing strategic acquisitions. This allows businesses to potentially achieve higher returns on equity by utilizing mezzanine financing as a growth catalyst.

Mitigating Risks for Senior Lenders

Mezzanine financing acts as a buffer between senior debt and equity financing. By providing an additional layer of capital, mezzanine financing helps mitigate risks for senior lenders. It reduces the senior lenders’ exposure and enhances their confidence in extending financing to the business, making it easier for the business to secure senior debt funding.

It is important to note that while mezzanine financing offers these advantages, it also comes with certain considerations and potential disadvantages. Businesses should carefully evaluate their specific needs, financial position, and growth prospects to determine if mezzanine financing aligns with their goals and risk tolerance.

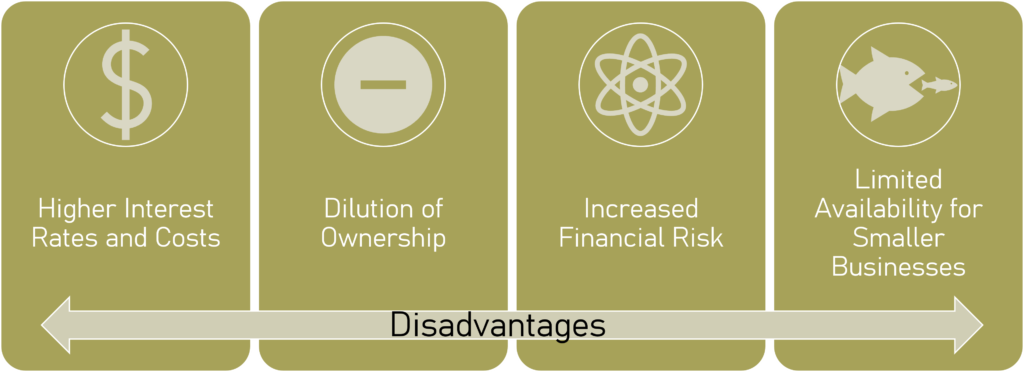

2.2 Disadvantages of Mezzanine Financing

While mezzanine financing offers benefits, it’s important to consider the potential disadvantages before opting for this type of funding. Let’s explore some of the key drawbacks:

Higher Interest Rates and Costs

Mezzanine financing generally carries higher interest rates compared to traditional bank loans. Since mezzanine lenders take on additional risk by providing subordinated debt or equity-like features, they expect a higher return on their investment. The higher interest rates and associated costs can impact the overall cost of capital for businesses.

Dilution of Ownership

In certain cases, mezzanine financing involves granting the lender the option to convert their debt into equity. If the lender exercises this option, it can lead to dilution of ownership for existing shareholders. This means that the business may have to share future profits and decision-making power with the lender-turned-shareholder.

Increased Financial Risk

Mezzanine financing adds an additional layer of debt to a business’s capital structure. While it provides flexibility, it also increases the financial risk for the business. If the business faces financial challenges or experiences a decline in performance, the burden of servicing the mezzanine debt along with other obligations may become more challenging.

Limited Availability for Smaller Businesses

Mezzanine financing is more commonly available to larger, established businesses with a proven track record and significant cash flow. Smaller businesses or startups may find it challenging to secure mezzanine financing due to the stringent eligibility criteria and the preference of mezzanine lenders for lower-risk opportunities.

It’s essential for businesses to carefully assess these disadvantages and evaluate their specific financial situation, growth prospects, and risk appetite before pursuing mezzanine financing. By weighing the advantages against the potential drawbacks, businesses can make informed decisions about the most suitable financing options for their needs.

Section 3: Key Considerations for Mezzanine Financing

For more information…

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.3.1 Evaluating Business Eligibility

Before pursuing mezzanine financing, businesses need to assess their eligibility based on certain criteria. Here are some key factors to consider:

Criteria for Qualifying Businesses

Mezzanine lenders typically seek businesses with a solid track record, positive cash flow, and a history of profitability. They prefer businesses with stable revenue streams and a demonstrated ability to generate sufficient cash flow to cover debt obligations. Lenders also consider factors such as industry prospects, competitive advantage, and management expertise.

Industry-Specific Considerations

Different industries have varying risk profiles and growth potential. Mezzanine lenders take this into account when evaluating eligibility. Businesses operating in stable or growing industries with favorable market dynamics may have a higher likelihood of securing mezzanine financing. On the other hand, industries with high volatility or uncertainty may face more challenges in accessing this type of funding.

Financial Health and Growth Potential

Mezzanine lenders assess a business’s financial health by reviewing its financial statements, including balance sheets, income statements, and cash flow statements. They analyze key financial ratios, such as profitability, leverage, and liquidity. Lenders also evaluate the growth potential of the business, considering factors like market demand, expansion plans, and the ability to generate returns on invested capital.

It is important for businesses to conduct a thorough evaluation of their eligibility for mezzanine financing before approaching lenders. This assessment helps businesses understand if they meet the necessary criteria and whether they can present a strong case for funding. Additionally, businesses should consider working with financial advisors who can provide guidance and support in preparing financial documentation and positioning the business effectively to potential mezzanine lenders.

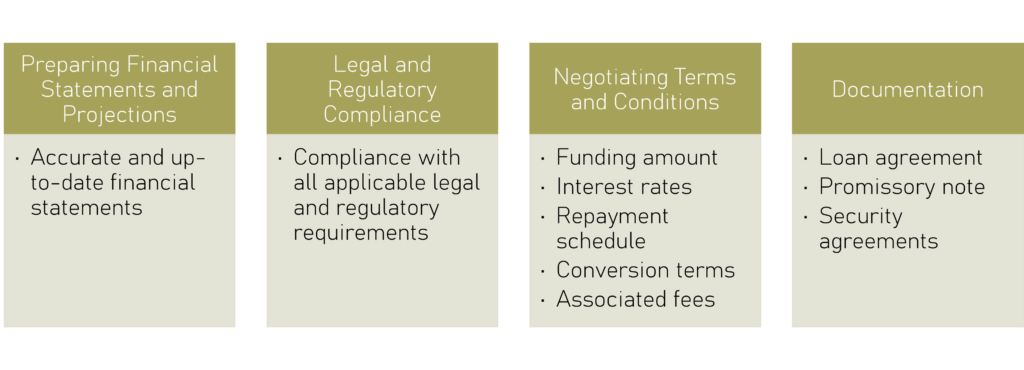

3.2 Due Diligence and Documentation

Before finalizing a mezzanine financing deal, businesses must undergo due diligence and complete the necessary documentation. This ensures that both the lender and the business have a clear understanding of the financial and legal aspects of the transaction. Here are key components of due diligence and documentation:

Preparing Financial Statements and Projections

Businesses must compile accurate and up-to-date financial statements, including balance sheets, income statements, and cash flow statements. These documents provide insights into the company’s financial health, performance, and ability to meet debt obligations. Additionally, preparing financial projections helps demonstrate the business’s growth potential and repayment capacity to the lender.

Legal and Regulatory Compliance

During due diligence, businesses must ensure they are in compliance with all applicable legal and regulatory requirements. This involves reviewing contracts, licenses, permits, and any other legal obligations. It is crucial to address any potential legal issues, such as outstanding lawsuits or disputes, to mitigate risks and reassure the lender of the business’s compliance.

Negotiating Terms and Conditions

Negotiating the terms and conditions of the mezzanine financing agreement is a crucial step. This includes determining the funding amount, interest rates, repayment schedule, conversion terms (if applicable), and any associated fees. Businesses should carefully review and negotiate these terms to ensure they align with their financial goals and capabilities. It’s advisable to seek legal and financial advice during this process to protect the business’s interests.

Documentation

Once the terms are agreed upon, the necessary documentation must be prepared. This includes the loan agreement, promissory note, security agreements, and any other legal documents required by the lender. These documents outline the rights, responsibilities, and obligations of both parties and provide a legal framework for the mezzanine financing arrangement.

Thorough due diligence and proper documentation are vital for a smooth and successful mezzanine financing process. They establish transparency, reduce risks, and set clear expectations for both the lender and the business. By meticulously preparing financial statements, ensuring legal compliance, and negotiating favorable terms, businesses can enhance their chances of securing mezzanine financing on favorable terms.

3.3 Mezzanine Financing Sources

For more information…

Understanding Mezzanine Financing Sources - Mezzanine financing sources provide businesses with diverse ways to acquire capital, extending beyond the conventional methods of debt or equity financing. Various entities exist, such as private equity firms, venture capital funds, mezzanine debt funds, commercial banks, business development companies, and family offices.

Understanding Mezzanine Financing Sources - Mezzanine financing sources provide businesses with diverse ways to acquire capital, extending beyond the conventional methods of debt or equity financing. Various entities exist, such as private equity firms, venture capital funds, mezzanine debt funds, commercial banks, business development companies, and family offices.

Businesses seeking mezzanine financing have various sources to explore. These sources provide the necessary capital in the form of subordinated debt or equity investments. Here are some common mezzanine financing sources:

Institutional Lenders and Private Equity Firms

Traditional institutional lenders, such as banks and financial institutions, often offer mezzanine financing options. These lenders have established processes and criteria for evaluating loan applications. Additionally, private equity firms that specialize in mezzanine financing may provide capital along with strategic guidance to fuel business growth.

Mezzanine Funds and Specialized Lenders

Mezzanine funds are investment vehicles that specifically focus on providing mezzanine financing to businesses. These funds pool capital from multiple investors to fund a portfolio of mezzanine investments. Specialized lenders also exist, focusing solely on mezzanine financing and tailoring their offerings to the unique needs of businesses seeking this type of funding.

Syndicated and Direct Financing Options

Syndicated financing involves multiple lenders coming together to provide a larger mezzanine financing package to a business. This option can be beneficial for larger funding requirements and allows lenders to share the risk. Alternatively, businesses can opt for direct financing, where they secure mezzanine financing directly from a single lender.

When exploring mezzanine financing sources, businesses should consider factors such as the lender’s expertise, reputation, track record, and alignment with the business’s industry and growth plans. It’s crucial to conduct thorough research, engage in discussions with potential lenders, and evaluate their terms and conditions to find the most suitable source of mezzanine financing.

By tapping into institutional lenders, private equity firms, mezzanine funds, specialized lenders, and exploring syndicated or direct financing options, businesses can access the capital they need to support their growth strategies and take advantage of valuable business opportunities.

Section 4: Mezzanine Financing Process

4.1 Initial Steps

For more information…

Mezzanine Financing: The Initial Steps - Mezzanine financing presents a good opportunity for businesses looking for funding solutions for their expansion needs. By taking a few initial steps, such as pinpointing your exact financial requirements, evaluating alternate financing avenues, and constructing a robust business rationale, entrepreneurs can pave the way for a successful partnership with the appropriate lender. It is crucial to involve experienced professionals and conduct meticulous analysis in order to find the right mezzanine financing partner.

Mezzanine Financing: The Initial Steps - Mezzanine financing presents a good opportunity for businesses looking for funding solutions for their expansion needs. By taking a few initial steps, such as pinpointing your exact financial requirements, evaluating alternate financing avenues, and constructing a robust business rationale, entrepreneurs can pave the way for a successful partnership with the appropriate lender. It is crucial to involve experienced professionals and conduct meticulous analysis in order to find the right mezzanine financing partner.

Before pursuing mezzanine financing, businesses should take several initial steps to set the stage for a successful funding process. Here are some important considerations:

Identifying Funding Needs

Businesses must carefully assess their funding requirements. This involves analyzing the purpose of the funds, whether it’s for expansion, acquisitions, working capital, or other specific needs. By identifying their funding needs, businesses can determine the appropriate amount of capital required to support their objectives.

Assessing Alternative Financing Options

While mezzanine financing can be a valuable option, it’s essential for businesses to evaluate other potential financing sources. This may include traditional bank loans, equity financing, venture capital, government grants, or crowdfunding. Assessing alternative financing options allows businesses to compare terms, interest rates, and repayment structures to determine the most suitable funding avenue.

Building a Strong Business Case

To attract potential mezzanine lenders, businesses must build a compelling business case. This involves showcasing the company’s growth potential, competitive advantage, market opportunity, and financial performance. Businesses should prepare a comprehensive business plan, highlighting key milestones, projected financials, and strategies for success. A strong business case increases the likelihood of securing mezzanine financing.

By taking these initial steps, businesses can lay a solid foundation for their mezzanine financing journey. By identifying their funding needs, exploring alternative financing options, and constructing a compelling business case, they can position themselves for success and increase their chances of securing the necessary capital for growth.

4.2 Finding Mezzanine Financing Providers

For more information…

Finding Mezzanine Financing Providers: A Step by Step Approach - Securing the ideal mezzanine financing provider requires extensive research, meticulous evaluation, and a strategic approach to the entire process. It is critical to honestly scope out your financial requirements, assess the provider's expertise, and consider factors such as reputation, flexibility, and support. Throughout this process, it is important to conduct thorough due diligence and seek guidance from professionals to ensure informed decision-making.

Finding Mezzanine Financing Providers: A Step by Step Approach - Securing the ideal mezzanine financing provider requires extensive research, meticulous evaluation, and a strategic approach to the entire process. It is critical to honestly scope out your financial requirements, assess the provider's expertise, and consider factors such as reputation, flexibility, and support. Throughout this process, it is important to conduct thorough due diligence and seek guidance from professionals to ensure informed decision-making.

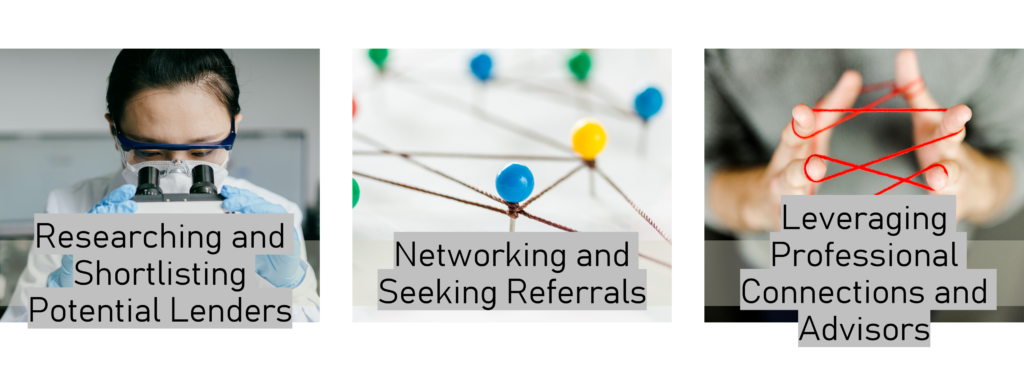

When searching for mezzanine financing, businesses need to identify and connect with suitable lenders who specialize in providing this type of funding. Here are some effective strategies for finding mezzanine financing providers:

Researching and Shortlisting Potential Lenders

Businesses should conduct thorough research to identify potential mezzanine financing providers. They can explore online resources, industry publications, and financial directories to gather information about lenders who offer mezzanine financing. It’s important to assess the lender’s experience, track record, reputation, and their alignment with the business’s industry and growth objectives. Based on this research, businesses can create a shortlist of promising lenders.

Networking and Seeking Referrals

Networking within the business community can be a valuable way to discover mezzanine financing providers. Attending industry conferences, trade shows, and business events can provide opportunities to meet professionals who can recommend lenders or share their experiences with mezzanine financing. Seeking referrals from trusted colleagues, mentors, or advisors can also lead to valuable connections with lenders who have a proven track record in providing mezzanine financing.

Leveraging Professional Connections and Advisors

Engaging with professionals and advisors who have expertise in finance, investment banking, or commercial lending can be advantageous. These individuals can provide valuable insights, connect businesses with potential mezzanine financing providers, and offer guidance throughout the funding process. Building strong relationships with accountants, lawyers, or financial consultants can open doors to reputable mezzanine financing sources.

By employing these strategies, businesses can uncover a pool of potential mezzanine financing providers. Researching, networking, seeking referrals, and leveraging professional connections and advisors can help businesses identify lenders with a strong reputation, industry expertise, and a track record of successful mezzanine financing deals.

4.3 Negotiating and Structuring the Deal

For more information…

Mezzanine Financing: Negotiating and Structuring the Deal - Mezzanine financing presents a flexible funding alternative for most companies looking to grow rapidly. However, to navigate the structuring of a mezzanine financing arrangement effectively, it is essential to understand the basic terms, align interests with the lender, and mitigate potential risks. Through systematic evaluation of the advantages and risks, borrowers can use this financial option to obtain the capital required for expansion while safeguarding ownership and control.

Mezzanine Financing: Negotiating and Structuring the Deal - Mezzanine financing presents a flexible funding alternative for most companies looking to grow rapidly. However, to navigate the structuring of a mezzanine financing arrangement effectively, it is essential to understand the basic terms, align interests with the lender, and mitigate potential risks. Through systematic evaluation of the advantages and risks, borrowers can use this financial option to obtain the capital required for expansion while safeguarding ownership and control.

Once a business has identified potential mezzanine financing providers, the next step is to negotiate and structure the deal. This involves careful consideration of key terms, involvement of legal and financial advisors, and finding a balance between the interests of the borrower and the lender. Here are important aspects to focus on:

Key Deal Terms and Covenants

During negotiations, businesses should pay close attention to key deal terms, such as the amount of financing, interest rates, repayment terms, and any potential equity components. Additionally, they should carefully review covenants, which are the conditions and restrictions placed on the borrower. These covenants may include financial performance targets, limitations on additional debt, or requirements for regular reporting. It is important to negotiate favorable terms that align with the business’s financial capabilities and growth plans.

Role of Legal and Financial Advisors

Engaging the expertise of legal and financial advisors is crucial during the negotiation and structuring phase. These professionals have experience in mezzanine financing transactions and can provide guidance on legal aspects, risk assessment, and financial implications. They can help businesses understand the implications of various terms and covenants, review the documentation, and ensure that the deal is structured in the best interest of the business.

Balancing Borrower and Lender Interests

Negotiating the terms of a mezzanine financing deal requires finding a balance between the interests of the borrower and the lender. Both parties aim to achieve their objectives while minimizing risk. It is important for businesses to clearly communicate their goals, financial projections, and growth plans to the lender, while considering the lender’s requirements and concerns. Successful negotiations result in a mutually beneficial agreement that supports the business’s growth and satisfies the lender’s risk appetite.

By focusing on key deal terms, involving legal and financial advisors, and finding a balance between borrower and lender interests, businesses can negotiate and structure a mezzanine financing deal that meets their funding needs and aligns with their long-term goals. Thoroughly understanding the terms, seeking professional advice, and fostering open communication are essential for a successful negotiation process.

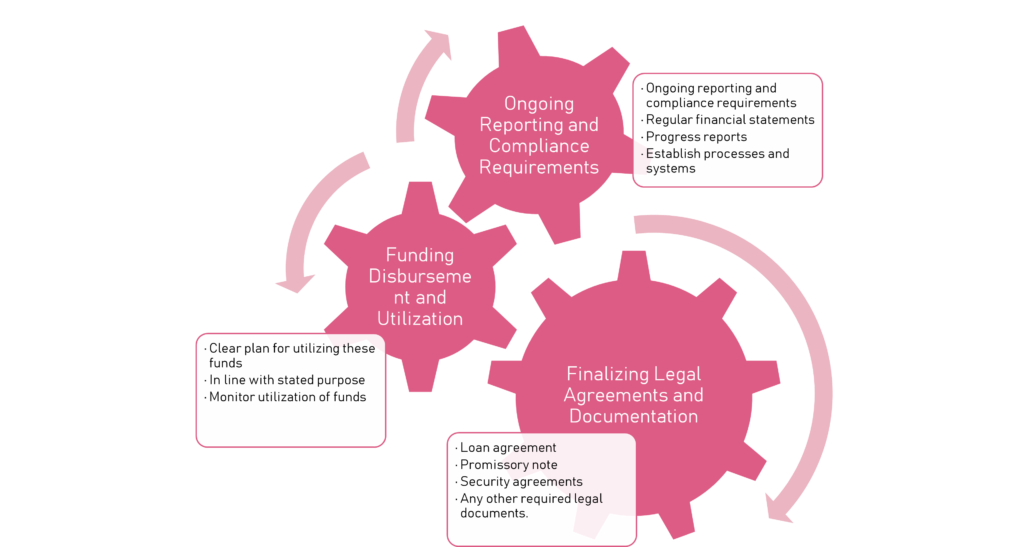

4.4 Closing and Post-Funding Considerations

After successfully negotiating and structuring a mezzanine financing deal, businesses must complete the closing process and address important post-funding considerations. These steps ensure a smooth transition from the funding stage to ongoing management and compliance. Here are key aspects to focus on:

Finalizing Legal Agreements and Documentation

Once the deal terms have been agreed upon, businesses need to finalize the legal agreements and documentation associated with the mezzanine financing. This includes preparing and executing the loan agreement, promissory note, security agreements, and any other required legal documents. It is essential to review these documents carefully, ensuring that all terms and conditions are accurately reflected and aligned with the negotiated deal.

Funding Disbursement and Utilization

After closing, the funds from the mezzanine financing will be disbursed to the business. It is important to have a clear plan for utilizing these funds effectively and in line with the intended purpose outlined in the funding agreement. Businesses should monitor the utilization of the funds, ensuring they are used for the intended purposes, such as expansion, acquisitions, working capital, or other specified objectives.

Ongoing Reporting and Compliance Requirements

Mezzanine financing typically involves ongoing reporting and compliance requirements. Businesses must fulfill these obligations, which may include providing regular financial statements, progress reports, and other relevant information to the lender. It is important to establish processes and systems to meet these reporting obligations and maintain compliance with the terms and covenants specified in the funding agreement.

By completing the closing process, finalizing legal agreements, effectively utilizing the funds, and fulfilling ongoing reporting and compliance requirements, businesses can ensure a successful post-funding phase. Proactively managing these considerations helps establish a strong relationship with the lender and maintains transparency and accountability throughout the mezzanine financing arrangement.

Conclusion

In this article, we have covered essential aspects of mezzanine financing, highlighting its significance as a strategic option for business growth. Let’s recap the key points discussed:

Introduction:

- What mezzanine financing is and how it differs from other forms of financing.

- Features of mezzanine financing, including its hybrid nature of subordinated debt and equity.

- Benefits it offers, such as flexible repayment terms, growth capital availability, and potential tax advantages.

- Importance of due diligence, documentation, and finding suitable mezzanine financing sources.

- The initial steps required, negotiating the deal, and post-funding considerations.

Role of Mezzanine Financing in Business Growth:

- Mezzanine financing plays a vital role in supporting business growth initiatives.

- It provides businesses with the necessary capital to fund expansion plans, acquire new assets or companies, invest in research and development, and enhance working capital.

- By accessing mezzanine financing, businesses can leverage additional capital to fuel their growth strategies and seize valuable opportunities in the market.

Mezzanine Financing as a Strategic Option:

- It is important to consider mezzanine financing as a strategic option when seeking funding for business growth.

- This financing option offers flexibility, enables businesses to retain control, and can be tailored to specific needs.

- By conducting thorough research, networking, seeking professional advice, and exploring case studies, businesses can gain insights and inspiration to make informed decisions about incorporating mezzanine financing into their growth plans.

In conclusion, mezzanine financing presents an attractive opportunity for businesses seeking capital for expansion, acquisitions, or other growth initiatives. By understanding its features, benefits, and the steps involved in securing it, businesses can make informed decisions and harness the potential of mezzanine financing. We encourage you to explore this strategic financing option and take advantage of its potential to drive your business towards success and achieve your growth aspirations.

Additional Resources

To further expand our knowledge and understanding of mezzanine financing, here are some recommended resources and references:

• “Mezzanine Financing: Tools, Applications, and Total Performance” by Luc Nijs

• “Mezzanine Financing: A Complete Guide” (2021 Edition) by The Art of Service – Mezzanine Financing Publishing (Author)

Additionally, you can explore relevant articles and websites such as Investopedia’s guide on mezzanine financing or publications from reputable financial institutions that provide insights and analysis on mezzanine financing.

By utilizing these additional resources, you can deepen your understanding of mezzanine financing, stay informed about industry developments, and access expert advice to support your financing decisions and business growth aspirations.