Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.

Introduction

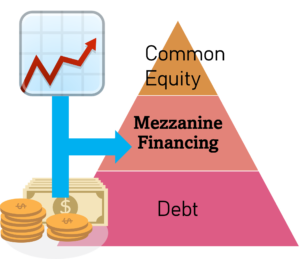

Mezzanine financing is a popular funding option for businesses looking to expand, acquire new assets, or undertake major projects. It sits between senior debt and equity, providing an attractive alternative for companies seeking additional capital. However, before diving into mezzanine financing, it’s crucial to understand the key considerations involved. In this article, we will explore the important factors to keep in mind when considering mezzanine financing for your business.

For more information, check out: The Comprehensive Guide to Mezzanine Financing

Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. Gain a comprehensive understanding of how it works, what are its advantages, and the process of obtaining mezzanine financing for your business! Read this guide and make a well-informed decision!

Understanding Mezzanine Financing

For more information…

Are Mezzanine Loans Risky? - Mezzanine financing sits above pure equity but below pure debt in terms of seniority. This means that it offers some security to investors, but also carries higher risks compared to traditional debt instruments. On the flip side, mezzanine financing also presents the potential for higher returns.

Are Mezzanine Loans Risky? - Mezzanine financing sits above pure equity but below pure debt in terms of seniority. This means that it offers some security to investors, but also carries higher risks compared to traditional debt instruments. On the flip side, mezzanine financing also presents the potential for higher returns.Mezzanine financing is a hybrid form of financing that combines elements of debt and equity. It typically involves a loan with an equity component, providing the lender with the opportunity to convert their debt into equity ownership in the company. This type of financing is often unsecured, meaning it does not require collateral, but it carries a higher interest rate compared to traditional bank loans.

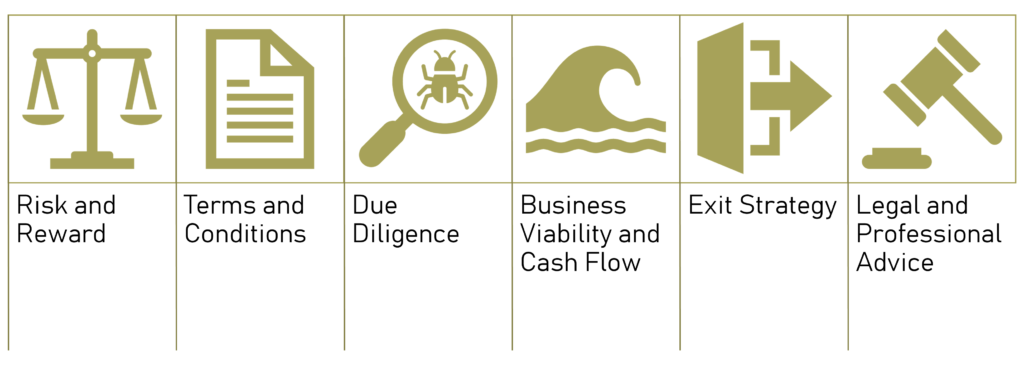

Risk and Reward

Mezzanine financing offers both advantages and risks. On the upside, it allows businesses to access significant amounts of capital without diluting existing ownership. The interest payments on mezzanine financing are also tax-deductible, providing potential cost savings. However, the higher interest rates associated with mezzanine financing increase the overall cost of capital for the business.

Terms and Conditions

Before entering into a mezzanine financing agreement, it is crucial to carefully review the terms and conditions. The agreement will outline the repayment structure, interest rate, conversion rights, and any associated fees. Understanding these terms is essential to ensure they align with your business’s financial goals and capabilities.

Due Diligence

Conducting thorough due diligence is vital when considering mezzanine financing. This involves evaluating the financial stability of the lender, their track record, and their reputation in the industry. It is essential to choose a reputable lender with experience in mezzanine financing to minimize potential risks and ensure a smooth transaction.

Business Viability and Cash Flow

Mezzanine financing is typically suitable for businesses with a strong cash flow and a proven track record. Lenders will assess the company’s ability to generate sufficient cash flow to make interest payments and repay the loan. It is crucial to evaluate your business’s financial health and determine if it can comfortably meet the obligations associated with mezzanine financing.

Exit Strategy

Having a clear exit strategy is crucial when considering mezzanine financing. The lender will want to know how and when they can expect to receive their repayment. Common exit strategies include refinancing the debt, selling the company, or generating enough cash flow to pay off the loan. Being prepared with a well-thought-out exit plan will help instill confidence in potential lenders.

Legal and Professional Advice

Given the complexity of mezzanine financing arrangements, seeking legal and professional advice is highly recommended. Consulting with experienced attorneys, accountants, and financial advisors can help you navigate the intricacies of the transaction, ensuring you make informed decisions and protect your interests.

For more information…

Finding Mezzanine Financing Providers: A Step by Step Approach - Securing the ideal mezzanine financing provider requires extensive research, meticulous evaluation, and a strategic approach to the entire process. It is critical to honestly scope out your financial requirements, assess the provider's expertise, and consider factors such as reputation, flexibility, and support. Throughout this process, it is important to conduct thorough due diligence and seek guidance from professionals to ensure informed decision-making.

Finding Mezzanine Financing Providers: A Step by Step Approach - Securing the ideal mezzanine financing provider requires extensive research, meticulous evaluation, and a strategic approach to the entire process. It is critical to honestly scope out your financial requirements, assess the provider's expertise, and consider factors such as reputation, flexibility, and support. Throughout this process, it is important to conduct thorough due diligence and seek guidance from professionals to ensure informed decision-making.Conclusion

Mezzanine financing can be a valuable tool for businesses seeking additional capital. However, it is essential to consider the various factors involved before moving forward. Understanding the risks and rewards, reviewing the terms and conditions, conducting due diligence, evaluating your business’s viability, having a clear exit strategy, and seeking professional advice are all critical steps to ensure a successful mezzanine financing arrangement. By carefully considering these key factors, you can make informed decisions and secure the capital necessary to drive your business forward.