Mezzanine financing presents a good opportunity for businesses looking for funding solutions for their expansion needs. By taking a few initial steps, such as pinpointing your exact financial requirements, evaluating alternate financing avenues, and constructing a robust business rationale, entrepreneurs can pave the way for a successful partnership with the appropriate lender. It is crucial to involve experienced professionals and conduct meticulous analysis in order to find the right mezzanine financing partner.

Introduction

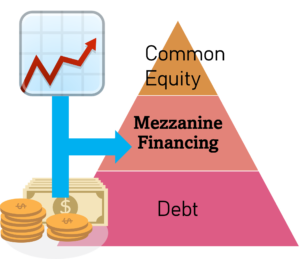

Securing adequate financing is crucial for businesses looking to expand, develop new products, or fund various projects. Mezzanine financing has emerged as a popular option, offering a flexible and versatile solution to bridge the gap between traditional debt and equity financing. In this article, we will explore the mezzanine financing process, covering the initial steps, identifying funding needs, assessing alternative financing options, and building a strong business case.

For more information, check out: The Comprehensive Guide to Mezzanine Financing

Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. Gain a comprehensive understanding of how it works, what are its advantages, and the process of obtaining mezzanine financing for your business! Read this guide and make a well-informed decision!

Initial Steps

Before delving into the mezzanine financing process, it’s essential to lay the groundwork for a successful funding journey. Here are the initial steps to consider:

Define your objectives

Clearly articulate your business goals and the purpose of seeking mezzanine financing. Whether it’s for expansion, acquisitions, or working capital, having a clear vision will guide your decision-making throughout the process.

Evaluate financial health

Assess your company’s financial standing by analyzing key financial statements, such as balance sheets, income statements, and cash flow statements. Understand your current debt and equity structure, profitability, and growth potential.

Engage professional advice

Seek the assistance of financial advisors, accountants, and legal experts experienced in mezzanine financing. Their expertise can help navigate the complex landscape, ensuring compliance and optimizing the financing structure.

Identifying Funding Needs

Determining the precise amount and purpose of the required funding is critical. Here’s how you can identify your funding needs:

Conduct a thorough assessment

Evaluate your business’s short-term and long-term capital requirements. Consider factors such as market conditions, competitive landscape, and anticipated growth plans. A detailed analysis will help you estimate the necessary funding amount.

Account for risk tolerance

Assess your risk appetite and the potential impact on your business operations. Balancing the desired level of leverage with operational and financial risks will guide you in determining the appropriate funding mix.

Project future cash flows

Utilize financial forecasting techniques to estimate future cash flows. This projection will assist in determining the repayment capacity and the impact of financing costs on your business’s financial performance.

Assessing Alternative Financing Options

For more information…

List of Mezzanine Financing Companies in the USA – June 2023 - When seeking mezzanine funding providers, it is essential to have access to a reliable and up-to-date list. Generic lists found on various websites often lack crucial details, making it difficult to effectively target providers. However, by leveraging the expertise and resources of mezzanine funding experts like GoodLoansGuide, you can gain a competitive edge and increase your chances of securing the right funding for your business.

List of Mezzanine Financing Companies in the USA – June 2023 - When seeking mezzanine funding providers, it is essential to have access to a reliable and up-to-date list. Generic lists found on various websites often lack crucial details, making it difficult to effectively target providers. However, by leveraging the expertise and resources of mezzanine funding experts like GoodLoansGuide, you can gain a competitive edge and increase your chances of securing the right funding for your business.Mezzanine financing should be evaluated alongside other financing options to ensure the best fit for your business. Consider the following alternatives:

Traditional debt financing

Explore bank loans, lines of credit, or asset-based lending, which typically offer lower interest rates and collateral requirements. Traditional debt is suited for businesses with strong credit profiles and predictable cash flows.

Equity financing

Consider equity funding options, such as venture capital or private equity, especially if your business has high growth potential but limited assets or collateral. Equity financing involves sharing ownership and control in exchange for investment capital.

Grants and subsidies

Investigate government programs, industry-specific grants, or subsidies that may align with your business objectives. These non-dilutive funding sources can provide a valuable boost to your financial resources.

Building a Strong Business Case

For more information…

Mezzanine Financing: Negotiating and Structuring the Deal - Mezzanine financing presents a flexible funding alternative for most companies looking to grow rapidly. However, to navigate the structuring of a mezzanine financing arrangement effectively, it is essential to understand the basic terms, align interests with the lender, and mitigate potential risks. Through systematic evaluation of the advantages and risks, borrowers can use this financial option to obtain the capital required for expansion while safeguarding ownership and control.

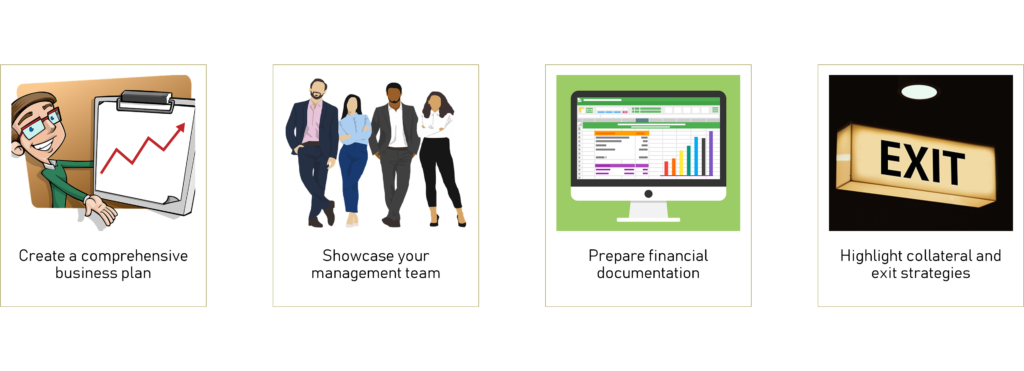

Mezzanine Financing: Negotiating and Structuring the Deal - Mezzanine financing presents a flexible funding alternative for most companies looking to grow rapidly. However, to navigate the structuring of a mezzanine financing arrangement effectively, it is essential to understand the basic terms, align interests with the lender, and mitigate potential risks. Through systematic evaluation of the advantages and risks, borrowers can use this financial option to obtain the capital required for expansion while safeguarding ownership and control.To secure mezzanine financing, it is crucial to build a compelling business case that showcases the potential for success. Here are some key considerations:

Create a comprehensive business plan

Develop a detailed business plan that outlines your company’s mission, market opportunity, competitive advantage, growth strategy, and financial projections. The plan should highlight how the mezzanine financing will contribute to achieving these objectives.

Showcase your management team

Emphasize the experience, expertise, and track record of your management team. Investors and lenders want assurance that capable individuals are leading the business towards success.

Prepare financial documentation

Compile accurate and up-to-date financial statements, including historical financials and future projections. Transparent and reliable financial information instills confidence in potential investors or lenders.

Highlight collateral and exit strategies

Identify and present any valuable assets or collateral that can provide security for the mezzanine lender. Additionally, describe potential exit strategies, such as IPOs, mergers, or acquisitions, which can ensure timely repayment of the financing.

Conclusion

The mezzanine financing process can be a viable option for businesses seeking flexible and growth-oriented funding solutions. By following the initial steps, identifying funding needs, assessing alternative financing options, and building a strong business case, entrepreneurs can position themselves for success. Remember to engage professionals, conduct thorough analysis, and present a compelling case to attract potential mezzanine financing partners. With careful planning and execution, mezzanine financing can fuel business growth and propel your company towards its goals.