Mezzanine financing presents a flexible funding alternative for most companies looking to grow rapidly. However, to navigate the structuring of a mezzanine financing arrangement effectively, it is essential to understand the basic terms, align interests with the lender, and mitigate potential risks. Through systematic evaluation of the advantages and risks, borrowers can use this financial option to obtain the capital required for expansion while safeguarding ownership and control.

Introduction

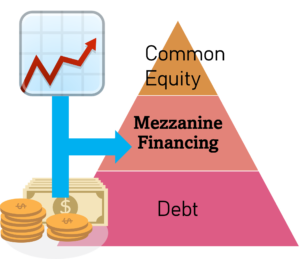

In the world of business, securing financing is crucial for growth and expansion. While traditional bank loans and equity investments are common options, there is a financing solution that often falls in between – mezzanine financing. Mezzanine financing bridges the gap between senior debt and equity and offers unique advantages to both investors and borrowers. This article will explore the key considerations for negotiating and structuring a mezzanine financing deal, empowering entrepreneurs and investors to navigate this flexible form of funding effectively.

For more information, check out: The Comprehensive Guide to Mezzanine Financing

Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. Gain a comprehensive understanding of how it works, what are its advantages, and the process of obtaining mezzanine financing for your business! Read this guide and make a well-informed decision!

Understanding Mezzanine Financing

Mezzanine financing is a hybrid form of financing that combines elements of debt and equity. It typically takes the form of a loan or a subordinated debt instrument, allowing the lender to convert their debt into equity under certain conditions. This flexible structure positions mezzanine financing between senior debt (secured loans) and equity investments (common or preferred shares). It offers borrowers the opportunity to access additional capital without diluting their ownership significantly, while investors benefit from higher potential returns.

Key Participants in a Mezzanine Financing Deal

a. Borrower: The company seeking additional capital through mezzanine financing.

b. Mezzanine Lender: The investor providing the financing, often an institutional investor or a specialized mezzanine fund.

c. Senior Lender: The primary lender with the first claim on the borrower’s assets.

d. Equity Sponsor: In some cases, an equity sponsor, such as a private equity firm, may be involved in the deal to provide additional support or enhance the credibility of the borrower.

Negotiating Terms and Conditions

a. Structure and Size of the Investment: Mezzanine financing can be tailored to the specific needs of the borrower. Negotiate the amount, repayment terms, and the potential conversion to equity.

b. Interest Rate and Payment Terms: Determine the interest rate, payment frequency, and any applicable grace periods. Mezzanine financing often carries higher interest rates than senior debt due to its subordinated position.

c. Conversion Terms: Establish the conditions and mechanisms for converting the mezzanine debt into equity, such as an IPO or a predetermined timeframe.

d. Collateral and Security: Understand the lender’s requirements for collateral, guarantees, or other forms of security. Mezzanine lenders often have fewer collateral requirements than senior lenders.

Key Considerations for Structuring the Deal

For more information…

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.a. Due Diligence: Conduct thorough due diligence on the mezzanine lender, including their track record, reputation, and financial stability. Consider engaging legal and financial advisors to ensure a smooth negotiation process.

b. Alignment of Interests: Seek alignment between the borrower, mezzanine lender, and equity sponsor to ensure everyone’s objectives are aligned. Negotiate terms that provide incentives for all parties to work towards a successful outcome.

c. Subordination and Intercreditor Agreements: Understand the relationship between the senior lender and the mezzanine lender. Negotiate an intercreditor agreement that outlines the rights and priorities of each party to avoid potential conflicts.

d. Exit Strategy: Define the exit strategy for the mezzanine lender and establish clear milestones for repayment or conversion to equity. Align the exit strategy with the company’s growth plans and long-term financial objectives.

Benefits and Risks of Mezzanine Financing

| Pros | Cons |

| Access to Additional Capital | Higher Cost of Capital |

| Limited Dilution | Increased Financial Obligations |

| Flexibility | Potential Loss of Control |

For more information…

Exploring the Pros and Cons of Mezzanine Financing - Mezzanine financing offers a range of benefits and possible drawbacks for businesses and investors alike. It provides businesses with greater flexibility, borrowing capacity, customizable terms, and the potential for higher returns. The downsides could include higher costs, amplified risk, intricate structures, and the possibility of equity dilution. It is crucial to carefully evaluate these factors as they can significantly impact the overall viability of the financing option.

Exploring the Pros and Cons of Mezzanine Financing - Mezzanine financing offers a range of benefits and possible drawbacks for businesses and investors alike. It provides businesses with greater flexibility, borrowing capacity, customizable terms, and the potential for higher returns. The downsides could include higher costs, amplified risk, intricate structures, and the possibility of equity dilution. It is crucial to carefully evaluate these factors as they can significantly impact the overall viability of the financing option.Benefits

- Access to Additional Capital: Mezzanine financing provides a valuable source of capital for growth-oriented companies.

- Limited Dilution: Unlike equity financing, mezzanine financing allows the borrower to retain a higher percentage of ownership.

- Flexibility: Mezzanine financing can be customized to the borrower’s specific needs, offering greater flexibility in terms and repayment schedules.

Risks

- Higher Cost of Capital: Mezzanine financing typically carries higher interest rates and fees compared to senior debt.

- Increased Financial Obligations: Mezzanine financing introduces additional debt obligations, which must be managed alongside existing debt and equity structures.

- Potential Loss of Control: In certain scenarios, the conversion of mezzanine debt to equity may result in dilution of ownership and potential loss of control for the borrower.

Conclusion

Mezzanine financing is a versatile funding option that can help companies achieve their growth objectives. When negotiating and structuring a mezzanine financing deal, it is crucial to understand the terms, align interests, and manage potential risks. By carefully considering the unique benefits and risks associated with mezzanine financing, borrowers can leverage this flexible financing solution to secure the capital necessary for expansion while preserving ownership and control.