Mezzanine financing offers businesses a distinct funding solution that blends debt and equity components. This financial structure acts as a bridge, filling the space between senior debt and equity, and empowers companies to secure supplementary capital for endeavors like expansion, acquisitions, or strategic initiatives. Nevertheless, it is essential to carefully assess the cost of capital, repayment capacity, and accompanying risks prior to selecting mezzanine financing.

Introduction

When it comes to financing a business or a project, entrepreneurs often find themselves exploring various options. One such option gaining popularity is mezzanine financing. Mezzanine financing structures provide businesses with a unique blend of debt and equity financing, offering flexibility and growth opportunities. In this article, we will delve into the world of mezzanine financing, exploring its definition, characteristics, benefits, and considerations. Let’s unlock the potential of mezzanine financing structures together.

For more information, check out: The Comprehensive Guide to Mezzanine Financing

Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. Gain a comprehensive understanding of how it works, what are its advantages, and the process of obtaining mezzanine financing for your business! Read this guide and make a well-informed decision!

Understanding Mezzanine Financing

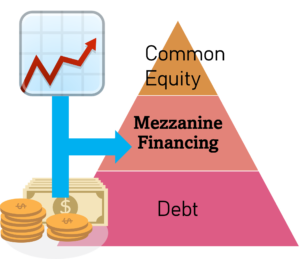

Mezzanine financing is a form of capital that sits between senior debt and equity financing. It combines elements of both debt and equity, providing companies with access to funds in exchange for a share in ownership or a higher interest rate. Mezzanine financing is typically used to bridge the gap between the amount of equity a business owner has invested and the total amount required for a project or expansion.

Characteristics of Mezzanine Financing Structures

Subordinated Debt

Mezzanine financing is considered subordinated debt, meaning it ranks lower in priority than senior debt in case of bankruptcy or default. This subordination carries a higher level of risk for the lender, resulting in a higher cost of capital for the borrower.

Flexible Terms

Mezzanine financing offers more flexibility compared to traditional debt financing. The terms and conditions can be customized to suit the specific needs of the borrower, including repayment schedules, interest rates, and other relevant factors.

Equity Participation

Mezzanine lenders may receive an equity stake in the company as a form of compensation. This equity participation gives the lender the potential to share in the future success of the business, aligning their interests with those of the borrower.

Benefits of Mezzanine Financing Structures

For more information…

What are the Benefits of a Mezzanine Loan? - A mezzanine loan offers numerous benefits to both the issuer and the investor. For the issuer, it provides increased access to capital, a reduction in capital cost, and enhanced equity returns. For investors, they can enjoy attractive investment opportunities, with the potential for high returns and the possibility of acquiring an equity stake in successful companies.

What are the Benefits of a Mezzanine Loan? - A mezzanine loan offers numerous benefits to both the issuer and the investor. For the issuer, it provides increased access to capital, a reduction in capital cost, and enhanced equity returns. For investors, they can enjoy attractive investment opportunities, with the potential for high returns and the possibility of acquiring an equity stake in successful companies.Increased Leverage

Mezzanine financing allows businesses to access a larger pool of funds without diluting the existing ownership significantly. This increased leverage can be especially beneficial for companies looking to undertake expansion plans or strategic initiatives.

Minimal Ownership Dilution

Unlike pure equity financing, mezzanine financing structures offer an opportunity to secure funds without giving up a substantial portion of ownership. Business owners can retain control while still tapping into additional capital for growth.

Tax Advantages

Mezzanine financing may offer tax benefits due to the deductibility of interest payments. This can help reduce the overall cost of capital for the borrower.

Considerations for Mezzanine Financing

For more information…

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.

Key Considerations for Mezzanine Financing - Mezzanine financing is a great tool for businesses seeking additional financing. However, it is important to understand the potential risks and rewards, and examine the terms and conditions which will be applicable. By conducting a comprehensive due diligence, you can make a well-informed choice whether mezzanine financing is the right solution for your business.Cost of Capital

Mezzanine financing often carries a higher interest rate compared to traditional debt financing. Businesses need to carefully evaluate the cost of capital and assess whether the potential benefits outweigh the increased financial burden.

Repayment Ability

Mezzanine financing structures usually have shorter repayment terms, typically ranging from three to seven years. Companies must have a clear repayment plan and a solid financial strategy to meet the required payments within the specified timeframe.

Collateral and Risk

Mezzanine lenders may require collateral or security to mitigate their risk. This can include assets such as real estate, intellectual property, or a charge over the company’s assets. Businesses should be aware of the potential consequences of defaulting on mezzanine debt and carefully consider the associated risks.

Conclusion

Mezzanine financing structures provide businesses with a unique and flexible funding option that combines elements of debt and equity. By bridging the gap between equity and senior debt, mezzanine financing enables companies to access additional capital for expansion, acquisitions, or other strategic initiatives. However, it is crucial to consider the cost of capital, repayment ability, and associated risks before opting for mezzanine financing. By thoroughly evaluating these factors, businesses can make informed decisions and leverage mezzanine financing to unlock their growth potential.