Mezzanine financing offers a range of benefits and possible drawbacks for businesses and investors alike. It provides businesses with greater flexibility, borrowing capacity, customizable terms, and the potential for higher returns. The downsides could include higher costs, amplified risk, intricate structures, and the possibility of equity dilution. It is crucial to carefully evaluate these factors as they can significantly impact the overall viability of the financing option.

Introduction

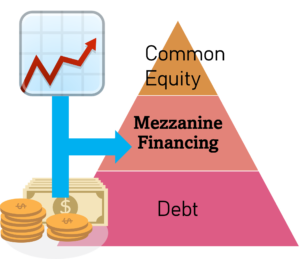

When businesses require additional capital to fuel their growth or fund new ventures, they often turn to various financing options. One such option that has gained popularity in recent years is mezzanine financing. This hybrid form of funding combines elements of debt and equity, providing unique advantages and disadvantages for both businesses and investors. In this article, we will delve into the world of mezzanine financing and explore its pros and cons.

For more information, check out: The Comprehensive Guide to Mezzanine Financing

Mezzanine financing offers a compelling prospect for companies in search of capital to fuel their expansion, acquisitions, or other growth endeavors. Gain a comprehensive understanding of how it works, what are its advantages, and the process of obtaining mezzanine financing for your business! Read this guide and make a well-informed decision!

Advantages of Mezzanine Financing

For more information…

What are the Benefits of a Mezzanine Loan? - A mezzanine loan offers numerous benefits to both the issuer and the investor. For the issuer, it provides increased access to capital, a reduction in capital cost, and enhanced equity returns. For investors, they can enjoy attractive investment opportunities, with the potential for high returns and the possibility of acquiring an equity stake in successful companies.

What are the Benefits of a Mezzanine Loan? - A mezzanine loan offers numerous benefits to both the issuer and the investor. For the issuer, it provides increased access to capital, a reduction in capital cost, and enhanced equity returns. For investors, they can enjoy attractive investment opportunities, with the potential for high returns and the possibility of acquiring an equity stake in successful companies.Flexible Financing Structure

Mezzanine financing offers a flexible structure that allows businesses to secure funds without diluting their ownership. Unlike traditional equity financing, mezzanine financing provides the opportunity to raise capital while maintaining control over the company’s operations and decision-making processes.

Enhanced Borrowing Capacity

By leveraging the company’s assets and future cash flows, mezzanine financing allows businesses to borrow a substantial amount of capital. This increased borrowing capacity can be especially beneficial for companies with limited collateral or those operating in industries with high capital requirements.

Customizable Terms

Mezzanine financing agreements can be tailored to meet the specific needs of the business. From interest rates to repayment schedules, these terms can be negotiated to align with the company’s cash flow patterns and growth projections. This flexibility can provide a significant advantage over traditional financing options.

Potential for Higher Returns

Investors who participate in mezzanine financing have the opportunity to earn higher returns compared to traditional debt investments. As mezzanine financing typically involves higher interest rates and potential equity kickers, investors can benefit from both the interest income and the potential upside if the company performs well.

Disadvantages of Mezzanine Financing

For more information…

What Happens If You Default on a Mezzanine Loan? - Unlike senior debt, mezzanine loans are not directly collateralized by the underlying real estate. Instead, it is secured by a pledge of the mezzanine borrower's ownership interest in the property owner, which is the entity that owns the underlying real estate. If a borrower defaults, the mezzanine lender can foreclose on the pledged ownership interest and become the new owner of the entity that owns the real estate. Defaulting on a mezzanine loan has significant implications for both borrowers and lenders.

What Happens If You Default on a Mezzanine Loan? - Unlike senior debt, mezzanine loans are not directly collateralized by the underlying real estate. Instead, it is secured by a pledge of the mezzanine borrower's ownership interest in the property owner, which is the entity that owns the underlying real estate. If a borrower defaults, the mezzanine lender can foreclose on the pledged ownership interest and become the new owner of the entity that owns the real estate. Defaulting on a mezzanine loan has significant implications for both borrowers and lenders.Higher Costs

Mezzanine financing usually comes with higher interest rates compared to traditional bank loans or senior debt. The added cost of capital can significantly impact a company’s profitability and cash flow, making it important to carefully assess the overall financial viability of the investment.

Increased Risk

While mezzanine financing offers investors the potential for higher returns, it also involves a higher level of risk. In the event of business underperformance or default, mezzanine lenders have a subordinate position to senior debt holders, potentially resulting in loss of capital.

Complex Legal and Financial Structures

Mezzanine financing transactions can be complex, involving intricate legal and financial structures. Companies seeking this type of financing may need to engage legal and financial experts to navigate the complexities and ensure compliance with applicable regulations. The associated costs and administrative burden should be considered when evaluating mezzanine financing as an option.

Potential Equity Dilution

Although mezzanine financing allows businesses to retain control, there is still a risk of equity dilution. If the company fails to meet the agreed-upon terms or defaults on the mezzanine financing, the lender may have the right to convert the debt into equity, leading to a reduction in the ownership stake of existing shareholders.

Conclusion

Mezzanine financing presents both advantages and disadvantages for businesses and investors. Its flexibility, enhanced borrowing capacity, customizable terms, and potential for higher returns make it an attractive option for companies in need of capital. However, the higher costs, increased risk, complex structures, and potential equity dilution should also be carefully considered. Ultimately, the suitability of mezzanine financing depends on the unique circumstances and goals of the business seeking funding.