Understanding the dynamics of mezzanine debt warrants is crucial for businesses engaged in financing transactions. These warrants play a vital role in bridging the gap between contractual interest payments and the desired rate of return for lenders. By comprehending the four components of mezzanine debt pricing and the mechanics of warrants, borrowers and lenders can navigate these agreements more efficiently.

Introduction

Mezzanine debt warrants play a crucial role in financing transactions, bridging the gap between contractual interest payments and the lender’s targeted rate of return. In this article, we will explore the components of mezzanine debt pricing, the concept behind warrants, their mechanics in live deals, and the potential outcomes associated with them.

Mezzanine Debt Pricing Components

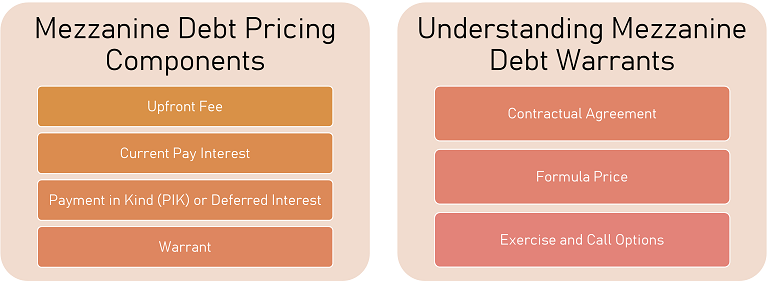

There are four key components to mezzanine debt pricing: the upfront fee, current pay interest, payment in kind or deferred interest, and the warrant. Let’s take a closer look at each of these components:

Upfront Fee

Typically ranging from one to two percent, the upfront fee represents a percentage of the total loan amount and serves as compensation for the lender’s initial investment.

Current Pay Interest

Mezzanine debt carries an interest rate, usually between 10 to 11 percent, which is payable throughout the loan term. This interest helps the lender generate ongoing income from their investment.

Payment in Kind (PIK) or Deferred Interest

Mezzanine debt may also include a provision for PIK or deferred interest. This means that instead of paying interest in cash, the borrower has the option to accrue the interest and pay it at a later date or convert it into additional debt.

Warrant

The warrant component is unique to each deal and plays a crucial role in achieving the lender’s targeted rate of return. The warrant represents the additional return the lender requires to bridge the gap between the contractual interest paid by the borrower and the desired rate of return.

Understanding Mezzanine Debt Warrants

The warrant is often misunderstood due to its name, which may sound negative or worrisome. However, in the context of mezzanine debt deals, the warrant is a common and collaborative element between the lender and the borrower.

Contractual Agreement

The warrant is a contractual agreement between the issuer (the borrowing company) and the purchaser (the lender). It establishes an obligation for the borrower to purchase the warrant in the future at a specified formula price.

Formula Price

The formula price of the warrant is determined based on the future EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of the company. The most commonly used valuation approach is the fair market value approach, which involves applying a multiple to the future EBITDA to calculate the Enterprise valuation. The warrant’s value is then derived by subtracting the debt from the Enterprise valuation to determine the net equity.

Exercise and Call Options

Typically, there are provisions that allow the purchaser (lender) to exercise the warrant after a specific period, or alternatively, the issuer (borrower) can call the warrant from the purchaser. This flexibility ensures both parties can act in their best interests while maintaining a cooperative relationship.

Outcomes and Performance Alignment

The warrant’s value is closely aligned with the financial performance of the company. Here are some key points to consider:

Positive Performance

If the company’s EBITDA and overall performance improve, the warrant holder will experience a good return on their investment.

Stable Performance

When a company maintains a stable performance without significant growth, the warrant’s return is limited.

Poor Performance

In the event of underperformance and declining company value, the warrant will have little to no value.

It’s worth noting that warrants are usually resolved in an amicable fashion. If a lender wants to refinance their loan, they often require the borrower to pay off the warrant, ensuring the lender can achieve liquidity on their investment.

Conclusion

Mezzanine debt warrants are an essential component of financing transactions, enabling lenders to bridge the gap between contractual interest payments and their desired rate of return. With an understanding of the four components of mezzanine debt pricing and the mechanics of warrants, borrowers and lenders can navigate these agreements more effectively. While the warrant’s value is contingent on the company’s performance, it typically aligns with the financial trajectory of the business. By comprehending the dynamics of mezzanine debt warrants, businesses can make informed decisions and build collaborative relationships with their lenders.